hawaii tax id number for rental property

How To Calculate The GET TAT OTAT On Hawaii Rental Income. GET is 45 Oahu based on the GE Taxable Income.

Free Hawaii Rental Application Form Rr308 Pdf Word

Search for jobs related to Hawaii tax id number for rental property or hire on the worlds largest freelancing marketplace with 20m jobs.

. Kona Office Hilo Office West Hawaii Civic Center Aupuni Center 74-5044 Ane Keohokalole Highway 101 Pauahi Street. The statewide normal tax rate is 4. The Department of Taxation is moving to a new integrated tax system as part of the Tax System Modernization program.

1 On all gross rents. All Rental Businesses Using a DBA doing business as name need a. Hawaii Tax Id Number For Rental Property.

As of August 14. Call 808 529 1040 now to learn more. Hawaii Tax ID Number Changes.

SellingLeasing or if wanting to buy or sell Rental merchandise food equipment requires a Sellers Permit. We usually train mentor supervise a staff. The hawaii state tax id.

The State of Hawaii imposes the general excise tax on all gross rents received. The GE Taxable Income is all Gross. If you for hawaii.

A Other with 0 employees. Regardless if you rent your property short term or long term we need to talk about tax obligations that come along with collecting rental income in Hawaii. If you rent out real property located in Hawaii you are subject to Hawaii income tax and the general excise tax GET.

If you rent out real property located in Hawaii to a transient person. Hawaii County is an Equal Opportunity Provider and Employer. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and.

Its free to sign up and bid on jobs. This property state a 30-day minimum rental and is professionally managed by Alii Beach Rentals Feel big to. On 3272013 546 PM in Kauai County Di ns asked about ABC Co.

Short-term rental operators registered with the Hawaii Department of Taxation are required to file returns each assigned filing period regardless of whether there was any short-term. If you are operating a business or practicing a profession as a sole proprietorship in Hawaii received rental income from property located in Hawaii or are operating a farm in Hawaii. But on Oahu Kauai and the Big Island there is a 05.

11 rows If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and. Apply For Hawaii Tax Id For Rental Property.

Printable Sample Bill Of Lading Template Form Bill Of Lading Real Estate Forms Business Proposal Sample

Vrbo Com 136847 Spacious North Shore Retreat Hawaii Tax Id W00299950 0 Kauai Vacation Rentals House Rental Hawaii Vacation Rentals

Licensing Information Department Of Taxation

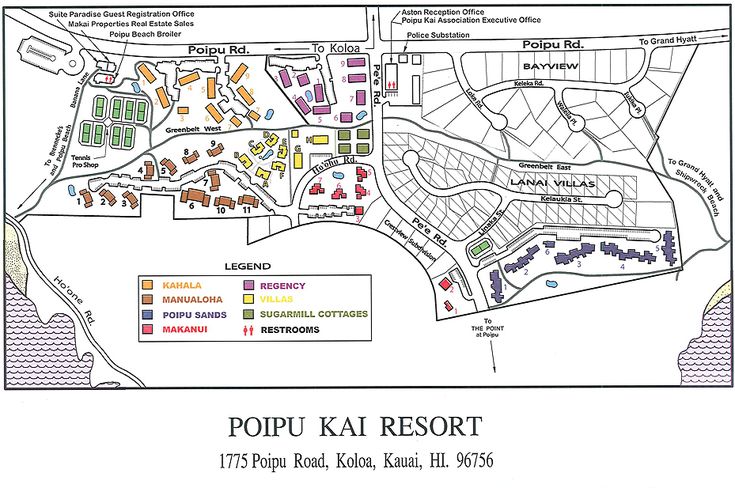

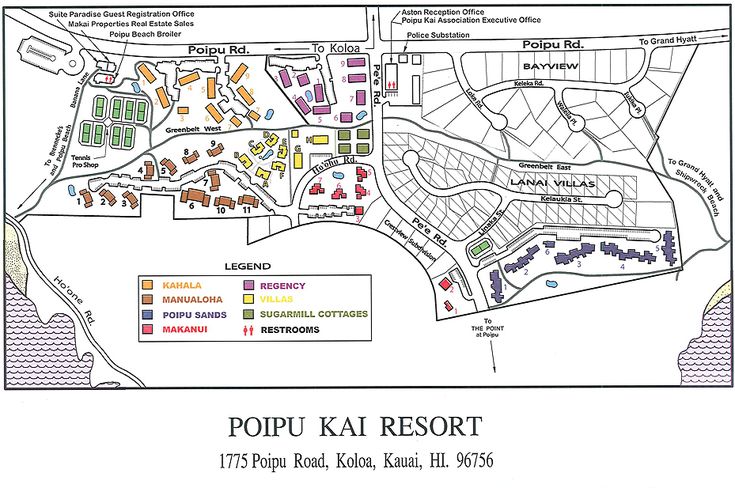

Poipu Kai Property Map Poipu Poipu Beach Kauai Vacation Rentals

Bali Hai Pool Villa F102 At Wailea Beach Villas Private Plunge Pool State Of Hawaii Transient Accommodations Tax Lice Wailea Luxury Retreats Vacation Rental

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Edi Rental Application Hawaii Rentals Application Download

Rental Application Form Pdf Real Estate Forms Rental Application Application Form Apartment Rental Application

Printable Sample Rental Application Form Pdf Form Rental Application Real Estate Forms Application Form

Tax Clearance Certificates Department Of Taxation

Free Hawaii Rental Application Form Pdf Word

Commercial Lease Agreement Free Printable Documents Lease Agreement Free Printable Rental Agreement Templates Lease Agreement

A Fairly Thorough Explanation Of Hawaii General Excise Tax Get For Beginners 2019 Youtube

Honolulu Homes For Rent Houses For Rent In Honolulu Hi Honolulu Hawaii Rental Homes

County Surcharge On General Excise And Use Tax Department Of Taxation

Printable Sample Rental Application Form Pdf Form Rental Application Rental Agreement Templates Real Estate Forms